A Blueprint for Climate Resilience: The Caribbean’s Perspective for The World

By H.E. David Comissiong, Ambassador of Barbados to the Association of Caribbean States (ACS)

The Bridgetown Initiative on the Reform of International Development and Climate Finance Architecture is not a dialogue about numbers, but an agenda for lives of dignity for billions across the globe.

In 2023, the global average near-surface temperature reached 1.45 degrees Celsius above pre-industrial levels, with temporary spikes breaching the critical 1.5-degree threshold. Indeed, we now live in a world of climate superlatives marked by unprecedented extremes – the hottest day on record, the most severe drought, the heaviest flooding, the wildest fires and the list goes on. In the month of June, the Caribbean was hit by Hurricane Beryl: the earliest category 5 hurricane on record in the Atlantic Hurricane Season. Following little reprieve, the Greater Caribbean again faced the onslaught of catastrophic cyclones in Hurricanes Helene and Milton.

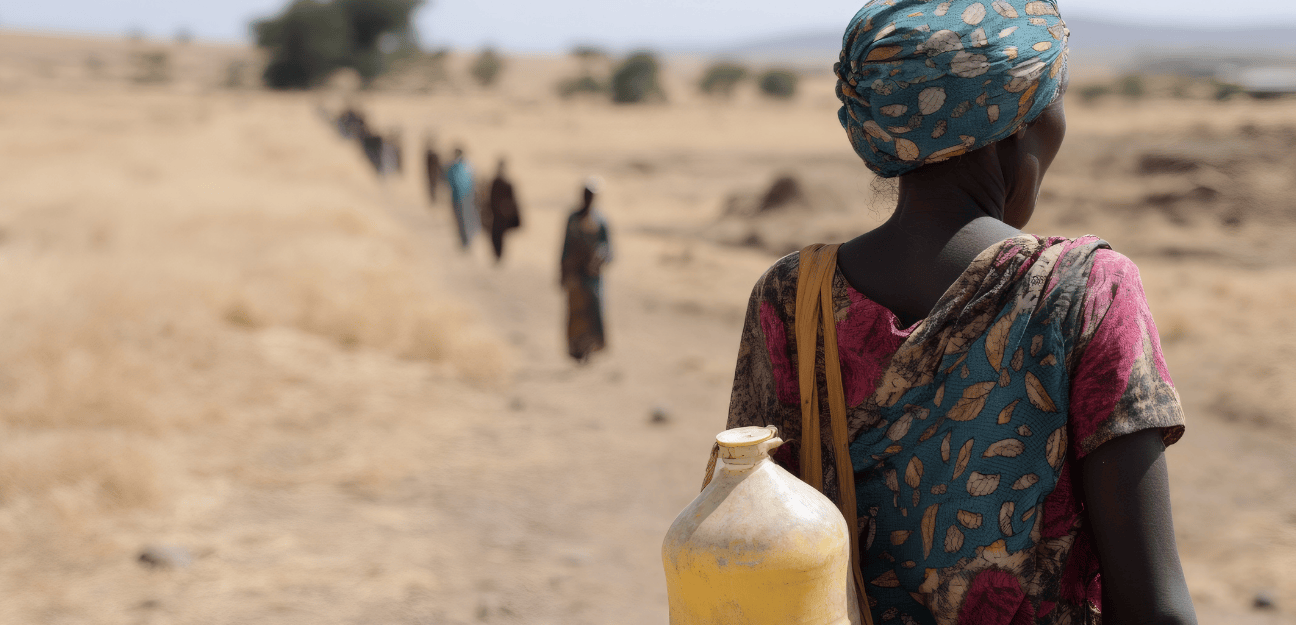

Sadly, for billions across the Global South, the Climate Crisis is no longer an impending threat, it is a grim reality. The nations most vulnerable to its impact are the developing countries of the Caribbean, Africa, Latin America, and Asia, home to some 4.5 billion people, half of whom live in poverty. These nations, often those least responsible for causing the Climate Crisis, are trapped in a cruel paradox where they bear the brunt of climate catastrophes while grappling with the perennial challenges of alleviating entrenched poverty and bridging the development gap left by centuries-old stumbling blocks.

At the heart of the global discourse on climate lies a bold proposal from a small island state with an outsized vision: the Bridgetown Initiative. Named after the capital city of Barbados, the Bridgetown Initiative demands nothing short of a radical transformation of the international financial system, insisting that it be equipped with the capacity, scale, ambition, and intent to enable vulnerable countries to simultaneously pursue sustainable development and climate resilience.

Reimagining the Global Financial Architecture

The Bridgetown Initiative revolves around the principle that low and middle-income countries cannot be forced to choose between achieving poverty eradication or development and striving towards vital climate adaptation and mitigation. It therefore proposes a new paradigm for international development where climate action and economic justice converge, and further demands a restructured global financial framework that allows nations to advance the Sustainable Development Goals (SDGs) while addressing the escalating threats posed by the Climate Crisis.

The global community has begun to acknowledge the urgency of these reforms. The International Monetary Fund (IMF) has established the Resilience and Sustainability Trust (RST), and the G20 has pledged to re-channel over $100 billion in Special Drawing Rights (SDRs). Similarly, COP28 witnessed the launch of a Loss and Damage Fund with an initial commitment of $700 million aimed at compensating countries that are coping with the adverse effects of the Climate Crisis. Multilateral Development Banks (MDBs) are also responding, incorporating natural disaster clauses into new loan agreements and supporting innovative mechanisms like debt-for-nature swaps. These are all positive developments that the earlier iterations of the Bridgetown Initiative advocated for.

Still, there is much work left to be done. The latest iteration of the Bridgetown Initiative – BI 3.0 – hinges on three core pillars: rewriting the rules of international finance, building out climate-resilient economies, and drastically increasing the scale of financing for the SDGs and climate action.

A Roadmap for Equitable Climate Finance and Development

The Bridgetown Initiative 3.0 provides a roadmap for reform that, if implemented, could reshape the global financial architecture for the better:

1. Developing countries must have a greater voice in the governance of financial institutions like the IMF and World Bank, ensuring that their interests are represented in decisions that directly affect their future.

2. The G20 must reform the Common Framework in order to better address borrower needs to guarantee that debt relief is sufficiently robust for countries to finance their development and climate goals;

3. The IMF/World Bank must update the growth forecasting methodologies that feed into Debt Sustainability Analyses (DSA) frameworks to better reflect current realities;

4. Credit Rating Agencies must improve the transparency and consistency of their methodologies to make ratings outcomes more predictable for both market participants and issuers;

5. The World Bank and other finance providers must include climate vulnerability, natural capital and biodiversity conservation needs in their criteria for allocating concessional finance;

6. The international financial system must facilitate a multilateral trading regime that supports a green and just transition. Countries must revive a constructive dialogue on the establishment of a universal carbon pricing mechanism and develop high integrity carbon markets;

7. The IMF must boost country capacity to invest in resilience, including by re-channelling SDRs through Multilateral Development Banks (MDBs).

8. The IMF must reduce the cost of lending, including by making it easier to access the Resilience and Sustainability Facility (RSF) on a stand-alone basis;

9. International financial institutions must enhance disaster preparedness by providing immediate liquidity support to all climate-vulnerable countries in the aftermath of a climate disaster. This is especially critical for the disaster-prone countries of the Greater Caribbean;

10. New and existing donor countries must replenish IDA21 by at least $120 billion and triple IDA by 2030, and donor countries must strengthen existing vertical climate finance funds, including the Green Climate Fund (GCF);

11. MDBs must develop a plan to provide $300 billion a year in affordable, longer-term (30-50 year) financing for the SDGs;

12. MDBs must fully implement the G20 Capital Adequacy Framework (CAF) recommendations to improve lending. MDB shareholders must initiate new general capital increases to ensure that MDBs can provide ongoing support to developing countries to aid in achieving their development and climate goals;

13. MDBs, DFIs and climate funds must help to mobilize at least $500 billion per year of private capital for climate action and the SDGs;

14. New sources of progressive finance must be sought to fund GPGs and loss and damage including through: an international tax on the super-rich; repurposing harmful subsidies; taxing fossil fuel company windfall profits and implementing an emissions levy on hard-to-abate sectors; and a philanthropically-funded Global Compact for GPGs; and

15. Developed countries must meaningfully capitalize and effectively operationalize the Loss and Damage Fund and deliver on their commitment to increase international biodiversity finance to least $30 billion per year by 2030.

A Fair Future for All

The time for incremental change has passed. The Bridgetown Initiative offers a coherent and compelling agenda to secure lives of dignity for billions across the globe and to reverse the present trajectory towards a lost Earth by building a more responsive, fairer and more inclusive global financial system to fight inequalities, finance the climate transition, and accelerate the achievement of the Sustainable Development Goals.

The stakes could not be higher. The world can no longer afford to postpone the fundamental reforms needed to address these interrelated challenges. As the Climate Crisis intensifies, so too must our collective will to act, grounded in the shared recognition that humanity’s future depends on the decisions we make today.